Updates in the Management of Asthma

Eligibility

This is an 1199/City Education Fund sponsored program. No out-of-pocket cost for 1199/City Fund members. In order to participate, you must have been a full-time or part-time worker for at least one year at a New York City agency or facility participating in the 1199SEIU/City of New York Education, Child and Eldercare Fund.

Target Audience

This continuing education (CE) session was planned to meet the needs of pharmacists and other clinicians who routinely prescribe, verify, and/or monitor medications.

Activity Overview

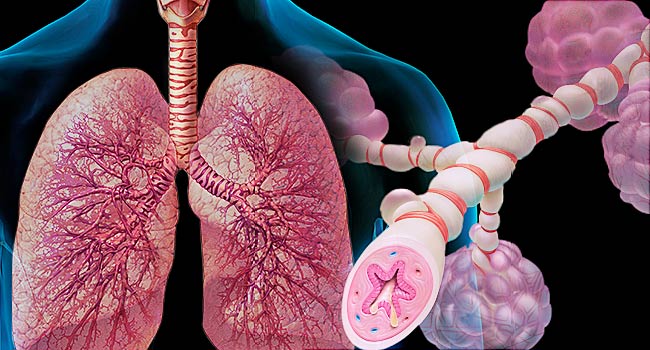

This presentation will review the current recommendations regarding asthma assessment and management and will give the audience the opportunity to apply asthma guideline recommendations to sample patient cases.

Learning Objectives:

- Describe the pathophysiology and clinical presentation of asthma

- List the diagnostic criteria for asthma and determine if a patient meets the diagnostic criteria

- Review updates to asthma management discussed in the GINA 2019 and 2020 reports

- Interpret literature supporting updates to the GINA 2019 and 2020 reports for asthma management

- Design therapy for a patient presenting with asthma based on GINA 2020 recommendations

- Recommend asthma therapy for a patient presenting with COVID-19 infection

- Identify any new warnings related to asthma drug therapy

- Develop an asthma treatment regimen for a patient presenting with worsening asthma or an asthma exacerbation

UAN: 0134-0000-20-180-L01-P

AUDIENCE: Intended for Health-system pharmacists, faculty, and pharmaceutical representatives.

PROGRAM TYPE: Knowledge-based

CONTINUING EDUCATION CREDITS:

The NYSCHP is accredited by the Accreditation Council for Pharmacy Education as a provider of continuing pharmaceutical education. This program is approved for 0.2 CEUs (total contact hours=2). Statements of Continuing Pharmacy Education Credit are available to participants upon the conclusion of the program with a survey link. Participant must verify attendance at the meeting by entering the program CE code.

Attendees have 45 days from the date of the program to retrieve their credits. Payments to NYSCHP or WNYSHP are not deductible as charitable contributions for federal income tax purposes. However, they may be deductible under other provisions of the Internal Revenue Code (i.e., ordinary, necessary business expenses; miscellaneous itemized deduction).

There are no fees associated with these activities.

*TECHNOLOGY REQUIREMENTS FOR ZOOM:

- Operating System: Mac OSX 10.9 or later OR Windows 7, 8, 8.1 or 10 (Note: For devices running Windows they must run Windows Home, Pro, or Enterprise. S Mode is not supported)

- Processor: Dual Core 2Ghz or Higher fi3/i5Ji7 or AMD equivalent)

- RAM: 4 GB

- Internet connection: Broadband wired or wireless (3G or 4G/LTE)

- Speakers and Microphone: built-in or USB plug-in or wireless Bluetooth

- Webcam or HD webcam: built-in or USB plug-in

Zdravko Smilevski | zdravko.smilevski@1199funds.org

Comments